Study Material and Notes of Ch 3 Money and Credit Class 9th Economics

Topics in the Chapter- Overview

- Money as a medium of exchange

- Modern form of money

- Loan activities of bank

- Two different credit situation

- Terms of credit

- Formal sector credit in India

- Self-help groups for the poor

• Introduction of money replaced the batter system. Before the introduction of money, Indians used grains and cattle as money. In batter system, selling and purchasing of goods and services was done with “double coincidence of wants” i.e by fulfilling mutual wants without the use of money. In this system goods and services was exchanged for another goods and services. It was also known as CC economy i.e commodity for commodity economy.

• The currency is authorized by the government of the country. So, it is used as medium of exchange and accepted by the others. In India, Reserve bank of India has authority to issue currency notes on behalf of the central government. In India, no individual can legally refuse to accept the rupees issued by the Reserve bank of India.

• A facility of payment through cheque is also provided by the bank to their customers. Cheque work as instrument for payment which is made by the paper. A person can directly transfer money to other person through cheque rather than in cash.

• Major portion of deposited money is provided to those people who are needy of money for economic activities.In this case, money is provided as loan with higher rate of interest. The difference between interest on borrowing money and the interest of deposited money is the income for the bank.

• Collateral is an assets of the borrowers which is given to the lenders as a securities for the specified period. A lender can use the assets which is hold by him as security, until the amount of loan is repaid. The lender has right to sell the assets or collateral when the borrower fail to repay the amount of loan in specified period.

(i) Formal sector

(ii) Informal sector

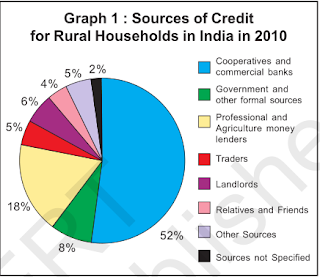

• In this chart we can see sources of credit in rural areas are mostly dependent on professional and agriculture moneylenders in case of informal sources of loan. For development of a country, cheap and affordable credit is crucial. Therefore, government should facilitate formal sources of credit basically in rural areas.

• The organization also provides self-employment opportunity for the member by the way of sanctioning the group. For example, small loans are provided to the members for releasing mortgaged land, for meeting working capital needs, for housing materials, for acquiring assets. There are also group for repayment of loan. In case of any non-repayment by the one member is followed by the other member of the organization.